Sedalia City Officials Outline FY 2026 Fee and Rate Adjustments Across Multiple Departments

In a series of detailed presentations to the City Council at the August 4, 2025 meeting, Sedalia Department Heads laid out proposed rate and fee adjustments for Fiscal Year 2026. The changes, city leaders say are necessary to keep pace with rising costs, address aging infrastructure, and ensure that services remain self-sustaining without placing undue burden on taxpayers. If approved by the Council, these rates could take effect in October 2025.

Why Adjustments Are Needed

Over the past several years, the City has experienced significant cost increases across nearly all operations due to inflation, supply chain disruptions, and rising service demands. Emergency repairs — from water main breaks to critical facility needs — often require dipping into the City’s General Fund, which diverts resources from other essential programs and services.

Delaying necessary adjustments risks service interruptions, deferred maintenance, and more costly emergency repairs down the line. These changes are about sustaining the services residents rely on every single day.

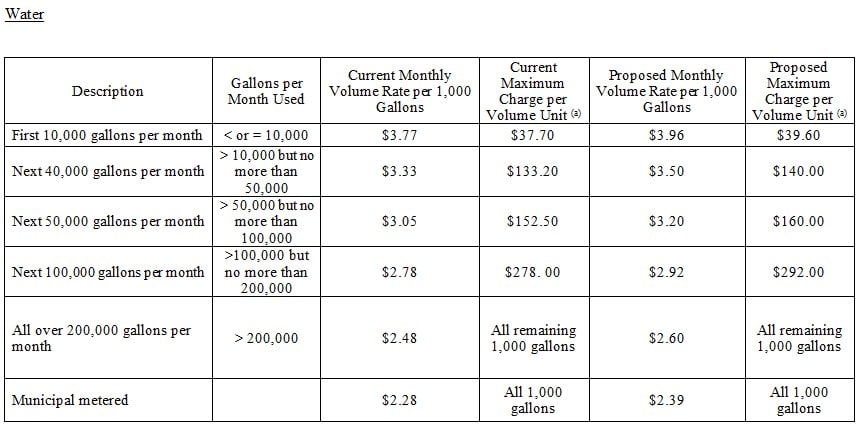

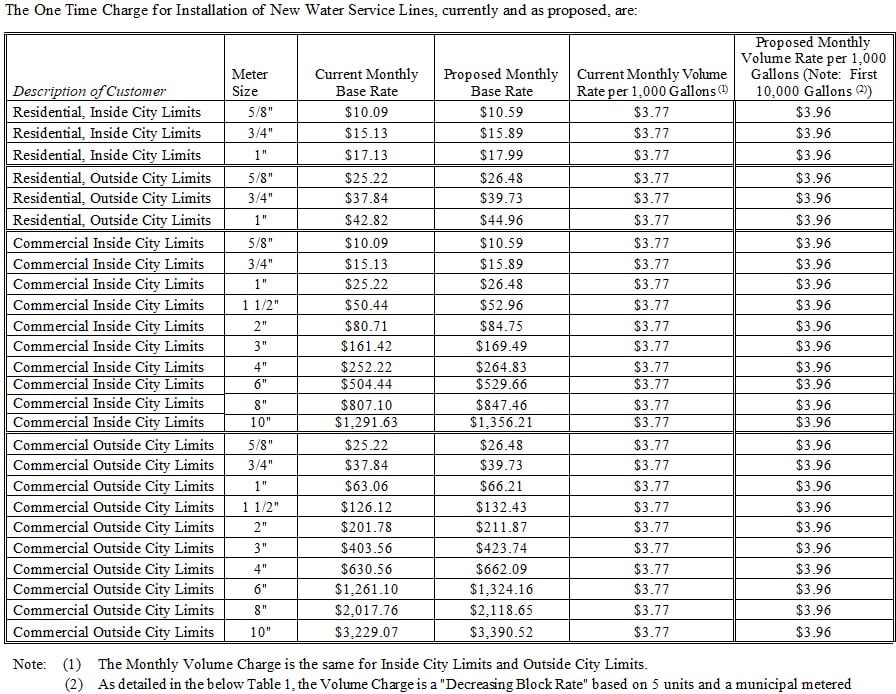

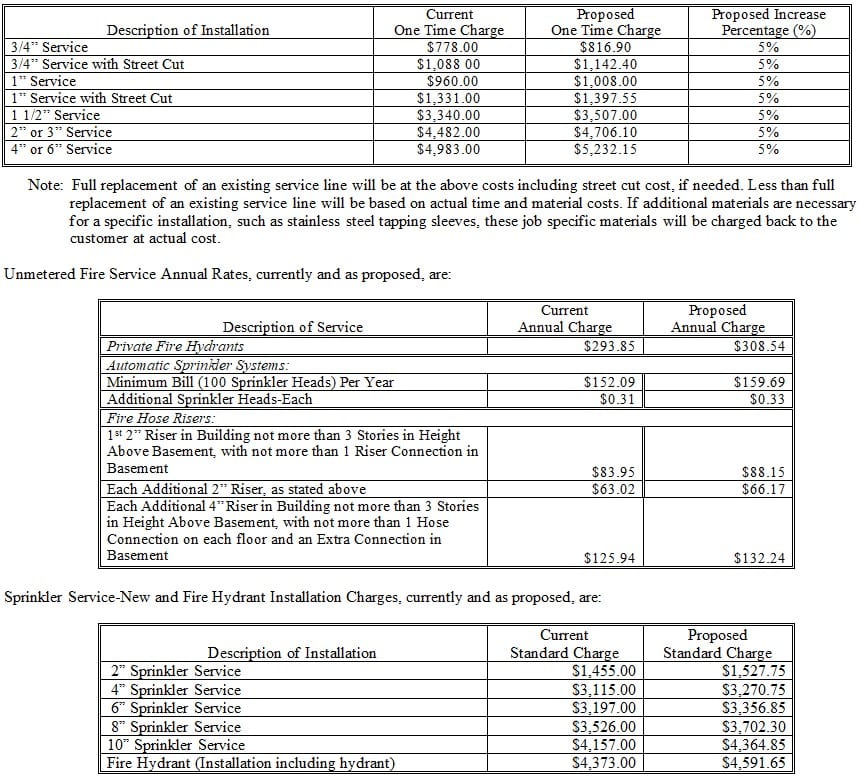

Utilities Department: Addressing Rising Costs and Infrastructure Needs

Director of Utilities William Bracken, emphasized that Sedalia’s Water and Wastewater utilities operate as enterprise funds, meaning they are fully self-supported by user fees and receive no money from the City’s general tax fund.

Since 2021, the department has faced steep price increases for critical materials:

- Plastic pipe and components: 50-85% higher

- Brass and stainless components: 75% higher

- Tariff charges: 15-25% higher

Repair component costs alone have surged from $99,000 in 2021 to $446,008 in 2025. In addition, the city’s fleet of 41 utility vehicles is aging, requiring costly repairs or replacement at a rate of 3–4 vehicles per year with prices rising an average 6.5% annually.

Staffing also remains a challenge. Water and wastewater operations require highly trained personnel with advanced certifications in science and chemistry. Attracting and retaining such workers is difficult, prompting the City to design an incentive system for ongoing training and certification advancement.

Proposed Action: Bracken urged a strategy of smaller, yearly rate adjustments to avoid sudden spikes in the future. For FY 2026, he requested a 5% increase in water rates and 7.5% in wastewater rates.

Impact on typical household: A family using 5,000 gallons per month would see their bill rise from $81.82 to $87.25.

Regional comparison: Even with the increase, Sedalia’s rates would remain lower than Warrensburg’s ($120.51) and comparable to Marshall’s ($84.50).

Funds from the increase will go toward repairing underground infrastructure and making necessary treatment plant upgrades.

Cemetery Fees

Cemetery Sexton Roger Waters proposed raising prices for grave lots, burials, cremations, and related services for the first time in several years, while continuing to maintain 35,194 gravesites, 25,375 feet of roads, and 66 acres of ground

Highlights include:

- Cemetery Lots: Adult from $550 to $700; Babyland from $200 to $250

- Recording Cost/Deed: remains at $27

- Casket Burial (Adult): Weekday $600 to $750; Saturday $800 to $1,000; Sunday $1,000 to $1,300; Holiday $1,200 to $1,500

- Casket Burial (Child under 6): Weekday $200 to $250; Saturday $400 to $500; Sunday $600 to $700; Holiday $700 to $800

- Cremation Burial (Below Ground): Weekday $300 to $400; Saturday $400 to $550; Sunday $600 to $750; Holiday $700 to $850

- Cremation Burial (Above Ground): Weekday $150 to $200; Saturday $250 to $350; Sunday $450 to $650; Holiday $550 to $750

- Niche in Columbarium: $650 to $700

- Niche Door Engraving: $100 to $175

- Mausoleum Burial: Weekday $150 to $250; Saturday $250 to $350; Sunday $450 to $550; Holiday $550 to $650

- Disinterment: Adult Casket $850 to $1,500; Child under 6 $200 to $400

- Graveside Service Finished After 3:30 p.m.: Additional $200/hour (unchanged)

- Setting Military Grave Marker: No cost (unchanged)

Even with these adjustments, Crown Hill Cemetery’s rates remain below or comparable to those charged by other cemeteries in surrounding communities, which range from about $500 to $1,800 depending on location and services provided.

Animal Services

Animal Services Manager, Randi Battson, recommended revised adoption rates that better reflect the actual cost of preparing animals for adoption, while still keeping fees affordable compared to surrounding communities.

Currently, it costs the City a minimum of $199.11 to prepare a dog for adoption and minimum of $68.44 to prepare a cat. Preparing an animal for adoption includes spaying/neutering, heartworm testing, flea/tick treatment, deworming, vaccines, and rabies vaccinations. Animals that remain in the shelter for multiple months may accrue portions of these costs each month.

Current adoption rates:

- Cats: $35 (loss of at least $23.44)

- Kittens: $45

- Dogs/Puppies: $55-$150 (loss of at least $49.11)

Proposed adoption rates:

- Cats (6 months — 6 years): $65

- Kittens (under 6 months): $100

- Senior Cats (7+ years): $35

- Dogs: $55 — $350, with most ranging from $65 — $150

We also propose the City’s animal ordinance violation fees be updated to better reflect the cost of enforcement, animal care, and public safety measures provided by the Sedalia Animal Shelter. The current fee schedule is outdated and does not account for the rising costs of housing, medical treatment, and staff resources required for impounded animals.

- Running at Large (Current: $50.50)

New tiered penalties based on number of offenses and whether the animal is altered or unaltered.

First offense: $50 (altered)/$100 (unaltered)

Second offense: $75 (altered)/$200 (unaltered)

Third offense: $100 (altered)/$300 (unaltered) - Biting & Attacking (Current: $109.00)

First offense: $125 (altered)/$250 (unaltered)

Second offense: $250 + euthanasia (altered)/ $500 + euthanasia (unaltered) - Vicious Animal (Current: $233.50)

First offense: $150 (altered)/$300 (unaltered)

Second offense: $300 + euthanasia (altered) / $500 + euthanasia (unaltered)

Justification for Increases

- Public Safety — Higher penalties discourage repeated violations, reducing the risk of injury to residents and other animals.

- Cost Recovery — The shelter bears significant costs for housing, veterinary care, and enforcement, which have increased due to inflation, medical supply prices, and staffing needs.

- Accountability — Tiered rates place greater responsibility on owners of unaltered animals, who statistically contribute more to stray and aggressive animal incidents.

- Behavioral Deterrent — increasing penalties for repeat offenses encourages compliance and responsible pet ownership, decreasing shelter intake over time.

- Alignment with Best Practices — Proposed fees bring Sedalia closer to regional standards, ensuring penalties are proportionate to the severity and risk of the violation.

Records Requests

City Clerk Jason Myers proposed hourly rate increases for Missouri Sunshine Law requests — the first since 2017 — due to the sharp rise in both the number of requests and the amount of staff time required.

In 2021, the City processed 27 records requests totaling 7.75 hours, billing $218.46 for the year. By 2024, that number had climbed to 159 requests, requiring 67.5 hours of work and generating $2,940.10 in billed costs — a 252% increase in requests since 2021.

Missouri state statute establishes the formula used to calculate fees for providing records under the Sunshine Law, which takes into account the actual time spent and the hourly rate of the staff member fulfilling the request.

Proposed rates:

- Police records: $24.75 → $32.22

- Fire/general records: $23.60 → $29.67

Community Development

Director Bryan Kopp suggested increases to permit fees, appeal costs, annexation applications, and inspection charges, along with new fees for specialized services. The proposed changes aim to better recover the actual costs of providing these services, many of which currently operate at a loss to the City.

For example, appeals to the Planning & Zoning Commission and Zoning Board of Adjustment currently cost the City an average of $500 to provide, but the fee is only $350, resulting in a $150 loss per appeal — a 30% cost recovery rate. Under the proposal, both appeal fees would increase to $500, achieving full cost recovery.

Proposed rates include:

- Appeals to Planning & Zoning Commission: $350 → $500

- Appeals to Zoning Board of Adjustment: $350 → $500

- Notarizing Documents: $3 → $5 each

- New Fees: Annexation Fee $150; Floodplain Development Permit $100; Extra Inspection Fee $25; Additional $6 per $1,000 of construction value or fraction for mechanical, electrical, and plumbing permits.

- Penalty for Starting Construction Without Permit: 200% of applicable permit fee (unchanged)

- Building Permit Basic Fee up to $1,000 of construction value: $25 → $50

- Each Additional $1,000 value: remains at $6

- Reactivation of Lapsed Permit: remains at 50% of original fee (unchanged)

- Commercial Mechanical Permits: Basic fee up to $1,000 of construction value remains at $50; New $6 for “each additional $1,000 or fraction of construction value”

- Residential Mechanical Permits: Replaced with flat structure; furnace units, air cooling units now included in overall permit cost

- Electrical Permit Basic Fee (up to $1,000 of construction value): $25 → $50

- Permanent Service 201–1,000 amps: $40 → $50

- Plumbing Permit Basic Fee: $25 → $50

- Plumber’s Certificate Annual Fee: Journeyman $1 → $25; Master $5 → $25

- Demolition Permit: $25 → $100

- Appeals: $100 → $500

- Vacant Residential Properties Semi-Annual Fee: remains $200

- Late Payment Fee: remains $25/month or portion

These adjustments are designed to ensure that the cost of providing specialized services is covered by those who use them, rather than by the general taxpayer.

Public Works: Solid Waste

Public Works Director Justin Bray outlined a plan to adjust trash collection rates based on container size and frequency, reflecting actual landfill and operational costs. Bray noted that 86% of the City’s expenses for trash services are landfill fees, which are set externally and beyond the City’s control.

For the first time, Sedalia residents will be able to choose the size — and therefore the cost — of their trash cart. This new tiered system lets households select the service level that best matches their needs and budget:

- 35-gallon cart (1) – $15.00/month

- 65-gallon cart (1) – $19.50/month

- 95-gallon cart (1) – $22.50/month

- 95-gallon carts (2) – $26.00/month

- 95-gallon carts (3 or more) – $26.00 for first two, plus $22.50 for each additional

- Elderly discount – $2.00 off monthly rate

Previously, all households paid for the same 95-gallon cart regardless of how much trash they produced. This new structure gives residents more control over their costs and rewards those who generate less waste.

Next Steps

The City Council will review all proposals as part of the FY 2026 budget process. If approved, residents could see the new rates take effect in October 2025. Officials stressed that these adjustments were aimed at preserving service quality, maintaining infrastructure, and ensuring fairness by having users cover the costs of the services they consume.